Votemarket Analytics

🤔 The Purpose

Analytics (opens in a new tab) allow you to measure the actual impact of your vote incentive and compare it to other submitted vote incentives. You will also have access to the history of all rounds of your vote incentive, giving you a visual overview of the most effective period.

🔑 What can I find in the analytics ?

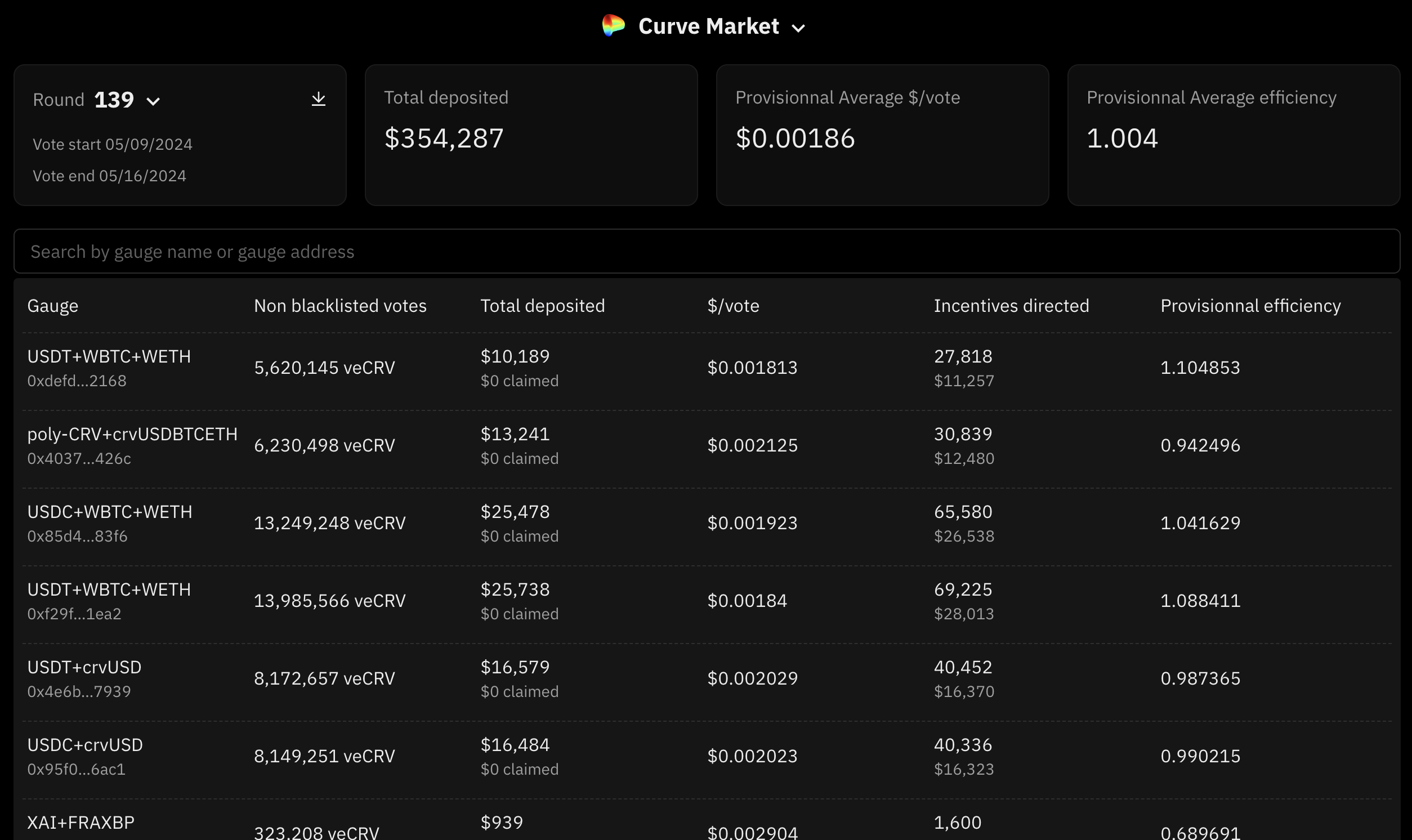

The analytics are displayed by round. For each round, you will in the header :

-

Round number

-

Round start/end date

-

Total deposited : the sum of all vote incentives total deposited

-

Average $/vote

-

Average efficiency

Then, you will find the list of vote incentives with for each the following data :

-

Gauge : gauge name / address

-

Non blacklisted votes : the number of actual votes that will receive the rewards

-

Total deposited : the total amount deposited for this round

-

$/vote : the reward amount received per vote

-

Incentives directed : the amount of inflation driven by the actual votes

-

Efficiency : the efficiency of the vote incentive. An efficiency greater than 1 indicates that the amount claimed for this vote incentive is less than the driven inflation.

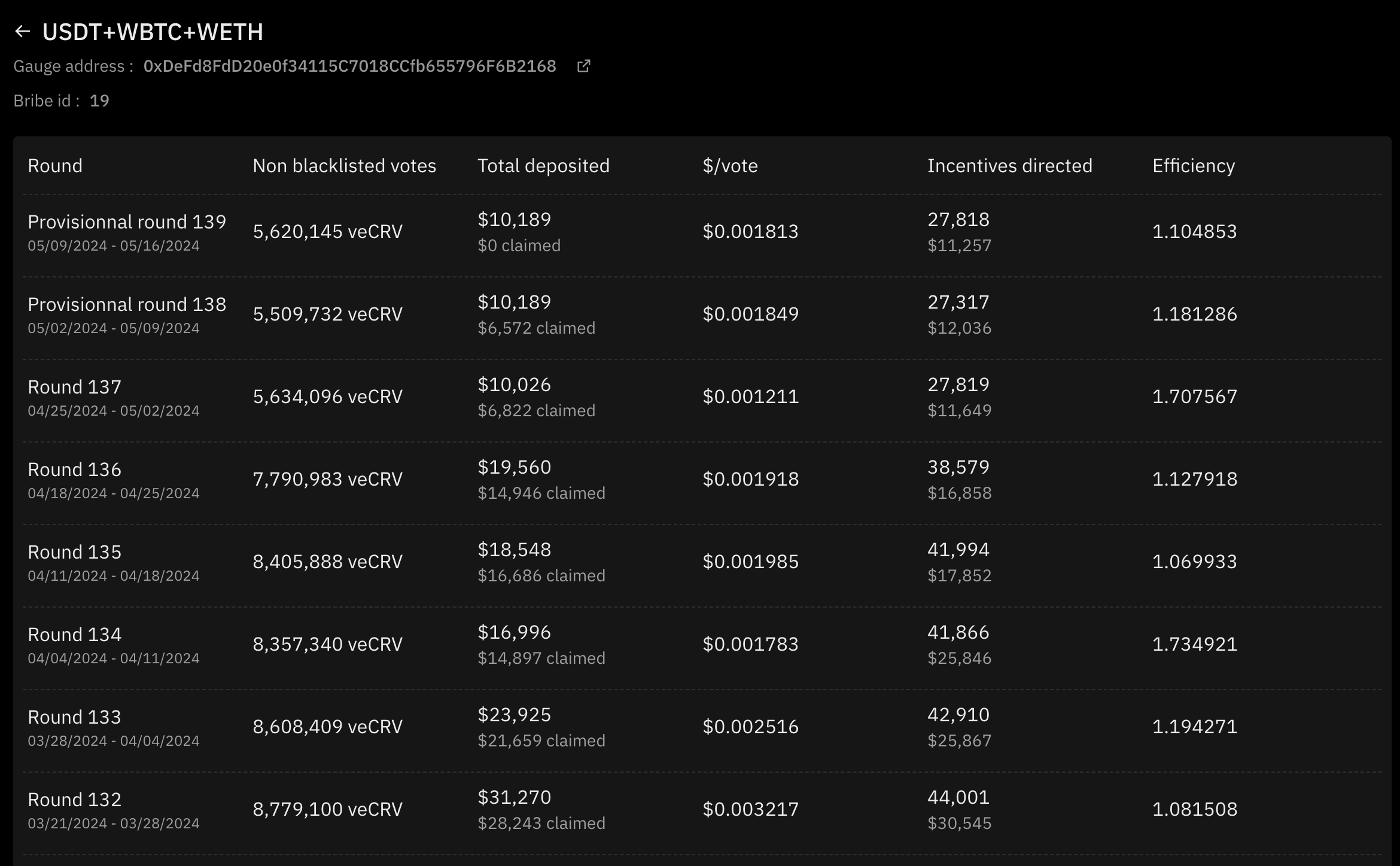

🔑 Analytics for a specific vote incentive

You can find a dashboard for a specific vote incentive with this link : https://votemarket.stakedao.org/analytics/[contract_address]/[vote_incentive_id (opens in a new tab)]

You will have access to the analytics of this vote incentive for each round on a single page. The columns of the table will be the same as on the previous page.

Formulas

Token reward price

Token reward price is the price at the start date of the round

Non blacklisted votes

Total deposited

If we're calculating the next round and we have an upgrade in queue, then :

Otherwise :

Total deposited in dollar

Amount claimed

Amount claimed in dollar

Dollar per vote

If the claim period is over :

Otherwise :

Incentives directed

For Curve :

For Balancer :

For the other protocols :

Efficiency

If we're calculating the current period, then :

Otherwise :