Liquid Lockers and sdTokens

The Power of Yield, Liquidity, and Governance in a Single Token

🤔 Why a Liquid Locker?

Liquid Lockers address a significant issue in the DeFi space. Previously, if a person or protocol wanted to use their lockable tokens (like CRV, FXS, etc.) for governance or for boosting yield, they faced a tough decision. They could either lock (opens in a new tab) on the native protocol, which allowed them to enjoy a yield and ability to vote through governance while losing liquidity.

Alternatively, they could use a locker, reap the benefits of boosted yield and yield farming, have the ability to exit with a limited penalty, but forfeit their governance power. This forced a choice between voting power and yield, imposing restrictions on users.

Liquid Lockers aim to offer the best of both worlds. They enable users to lock their tokens and receive sdTOKENs in return. Users can stake these sdTOKENs on Stake DAO to gain various benefits, such as native APR, a share of boosted strats rewards, the ability to sell voting rights of the underlying asset, and additional SDT incentives. They always have the possibility of exiting their position and returning to the underlying token.

🔑 Key Features

-

Yield (rewards earned through underlying protocol)

-

Liquidity (liquidity pools to exchange sdTokens)

-

Governance power (ability to vote on underlying protocol with sdTokens)

-

Vote incentives rewards (due to governance power)

-

Cross-chain accessibility

⚙️ How does it work?

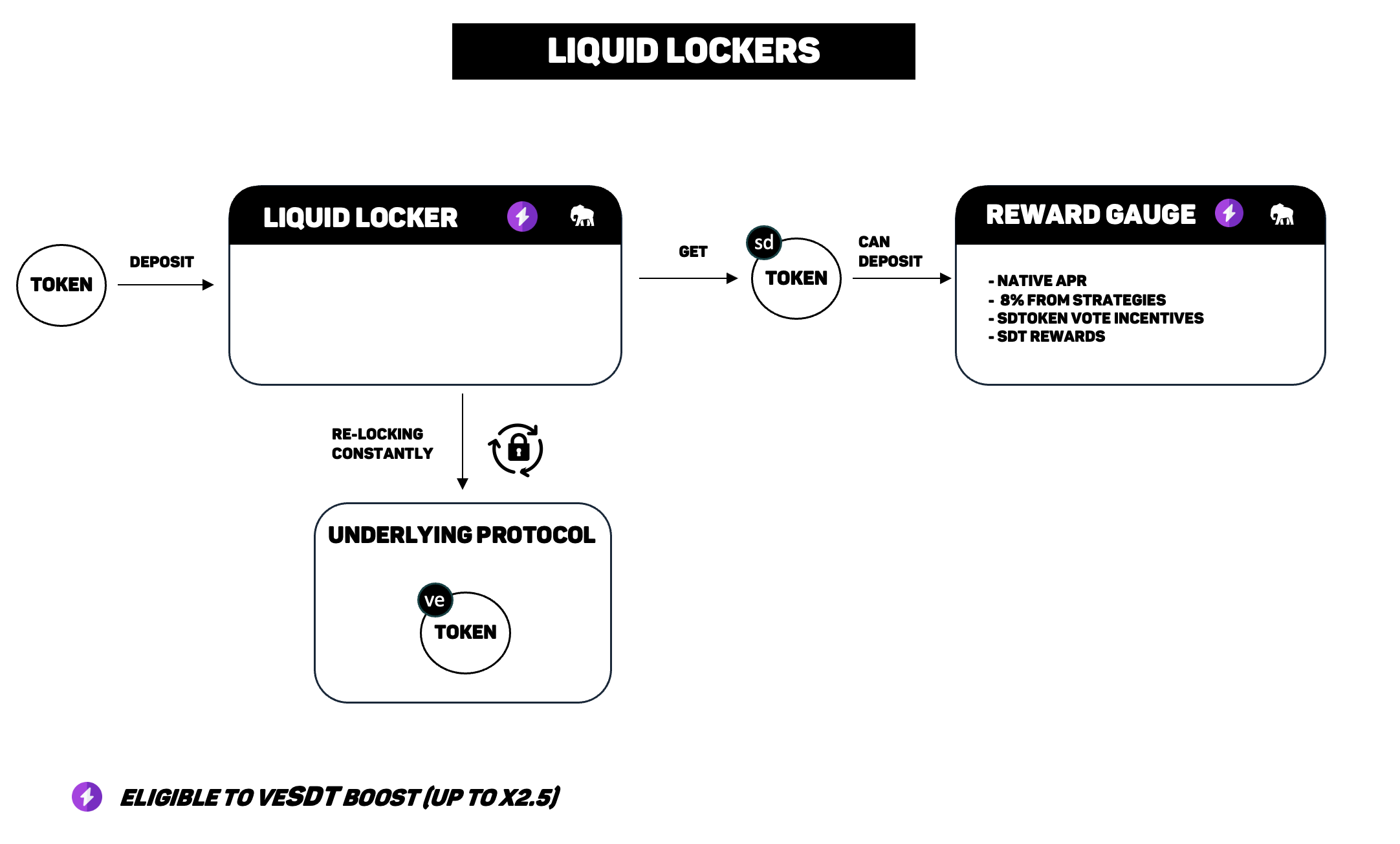

Each Liquid Locker is linked to a contract that receives protocol tokens and deposits them into the Locker. In return, sdTokens are issued.

After depositing, the native protocol (such as Curve) locks the tokens for a maximum duration of typically 4 years. Continuous relocking of these tokens enables the generation of maximum rewards.

The locked balance enables the boost, profiting the strategies on top of Stake DAO Liquid Lockers.

Once users possess sdTokens, they have the option to stake them directly on Stake DAO's to earn rewards generated by the protocol.

Alternatively, users can stake their tokens in the underlying protocol's trading pool (sdToken / token), allowing them to earn from trading fees, protocol rewards, and additional incentives.

Please note that the conversion rate between token and sdToken is subject to fluctuation based on the demand for each.

Here is a diagram to summarize how a Liquid Locker works

🔋 Voting Power

Users who have sdTokens can vote for underlying protocol proposals through a replication of the vote. It means that they are eligible for vote incentives (if there are any) offered by individuals and DAOs. These vote incentives are redistributed every 2 weeks by Stake DAO, and holders can vote accordingly and claim them whenever they please. In addition, holders who have staked their sdTokens on the Stake DAO gauge can earn extra rewards through veSDT votes (allocation).

Using the same boost formula as the Curve’s CRV reward logic, sdTOKEN holders will benefit from boosted voting rights depending on their veSDT balance. At a given point in time, the user's voting power is:

Where:

- UVP: User Voting Power

- TLVP: Total Liquid Locker Voting Power

- UAB: User Adjusted Balance of staked sdTOKEN

- UB: User Balance of staked sdTOKEN

- TB: Total Balance of staked sdTOKEN

- UV: User veSDT balance

- TV: Total veSDT supply

Example

Let's consider a scenario with three users: Alice, Bob, and Carol. Each of them has locked 500 CRV in the CRV Liquid Locker, and in return, they each receive 500 sdCRV.

- Alice stakes her sdCRV in the reward contract, but she doesn't hold any veSDT.

- Bob also stakes his sdCRV in the reward contract, but in addition, he holds 100 veSDT. This represents one-third of the total supply of veSDT, which at this time is 300 veSDT.

- Carol stakes her sdCRV in the Curve Factory pool along with 500 CRV. She owns 100% of the factory pool and benefits from the CRV rewards from the pool.

The Liquid Locker governs a total amount of 1,500 veCRV. On average, Alice and Bob have boosted their voting power by 1.5x due to their participation in the Liquid Locker. Furthermore, Bob's voting power is enhanced by his possession of veSDT.

According to the formulas detailed above, Bob’s adjusted balance (UAB) is equal to 400, while Alice’s UAB is equal to 200. Therefore, Bob is able to vote with 1,000 veCRV, effectively doubling his veCRV vote. This means he can benefit from twice the amount of vote incentives. On the other hand, Alice, who has no veSDT, is able to vote with 500 veCRV. This is the same amount she would have been able to vote with if she had locked her CRV for four years. Please note that this is just an illustrative example, and with different figures, Alice's voting power could have been between 400 and 500 veCRV.

In addition to these boosted voting rights, they also benefit from the performance fees coming from all Curve pools and SDT rewards that are also boosted with veSDT.

🤔 Why Choose sdTokens?

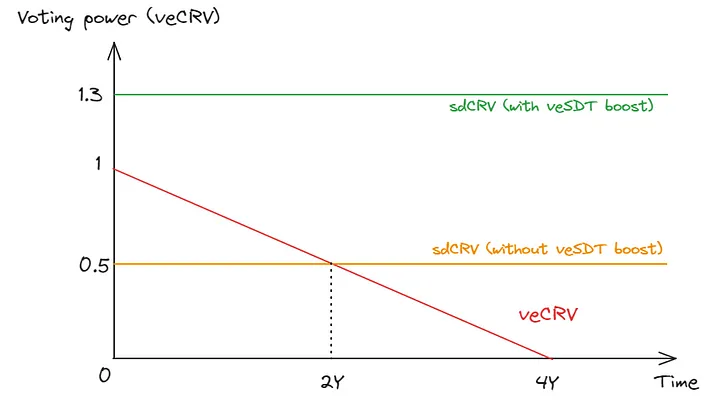

Opting for sdTokens, like sdCRV, offers clear advantages. Consider the sdCRV and veCRV case:

Locking CRV to get sdCRV, even without veSDT, grants you the voting power of veCRV locked for 2 years. This matches the average voting power of locking CRV for 4 years, thanks to the liquid locker's continuous re-locking, which keeps your voting power steady.

This example uses veCRV, but the same principles apply to other veTokens using the same formula.

⛓️ Cross-chain Liquid Lockers

For protocols that have their veToken on multiple chains, Stake DAO also provides Liquid Lockers for these. Users can now profit from the boost of the Liquid Locker, even on other chains.

📝 In Summary

Step 1: Deposit

Deposit your tokens into the Liquid Locker.

Step 2: Lock

The Liquid Locker locks your tokens, issuing sdTokens in return.

Step 3A: Stake

Stake your sdTokens on Stake DAO to earn rewards, and ability to vote.

Step 3B: Provide Liquidity

Add your sdTokens to the sdToken/token pool to earn trading fees and additional rewards.