📊 Gauges: Simplified Overview

🧮 What are Gauges?

In the realm of decentralized finance (DeFi), gauges are tools that help determine the rewards a liquidity provider can earn. When providers add liquidity to a pool, they can earn rewards, often in the form of the protocol's native token, like SDT for Stake DAO.

They also receive Liquidity Pool (LP) tokens in exchange (representing their share).

Think of a gauge as a scale. It measures the distribution of rewards for a specific liquidity pool. The more votes a gauge gets, the more rewards LPs can earn from that pool. Voting usually happens regularly, like once a week.

📏 The Gauge System

The gauge system's job is to guide token rewards to those who add liquidity to the protocol. This is tracked using "gauge" smart contracts. Each liquidity pool in a protocol has its own gauge.

Users deposit their LP tokens into the gauge to measure liquidity. The number of token rewards a gauge gets depends on the current inflation rate and the gauge's weight. Users then get a portion of the tokens based on how many LP tokens they've locked in the gauge.

🗳️ Voting for Gauges

Users can direct their voting power to one or more gauges. This allows them, if they have a position in it, to earn more rewards. Gauges get new tokens in proportion to their vote weight.

When a user casts a new weight vote, it takes effect at the start of the next voting period, like the next week. Users can't change the weight vote for a gauge more than once in a set period, like 10 days.

🎁 Vote incentives

Users can earn extra incentives, called "vote incentives", for voting for a specific gauge. Any DAO or individual can offer these incentives. This adds another layer of rewards for users to participate in the protocol's governance.

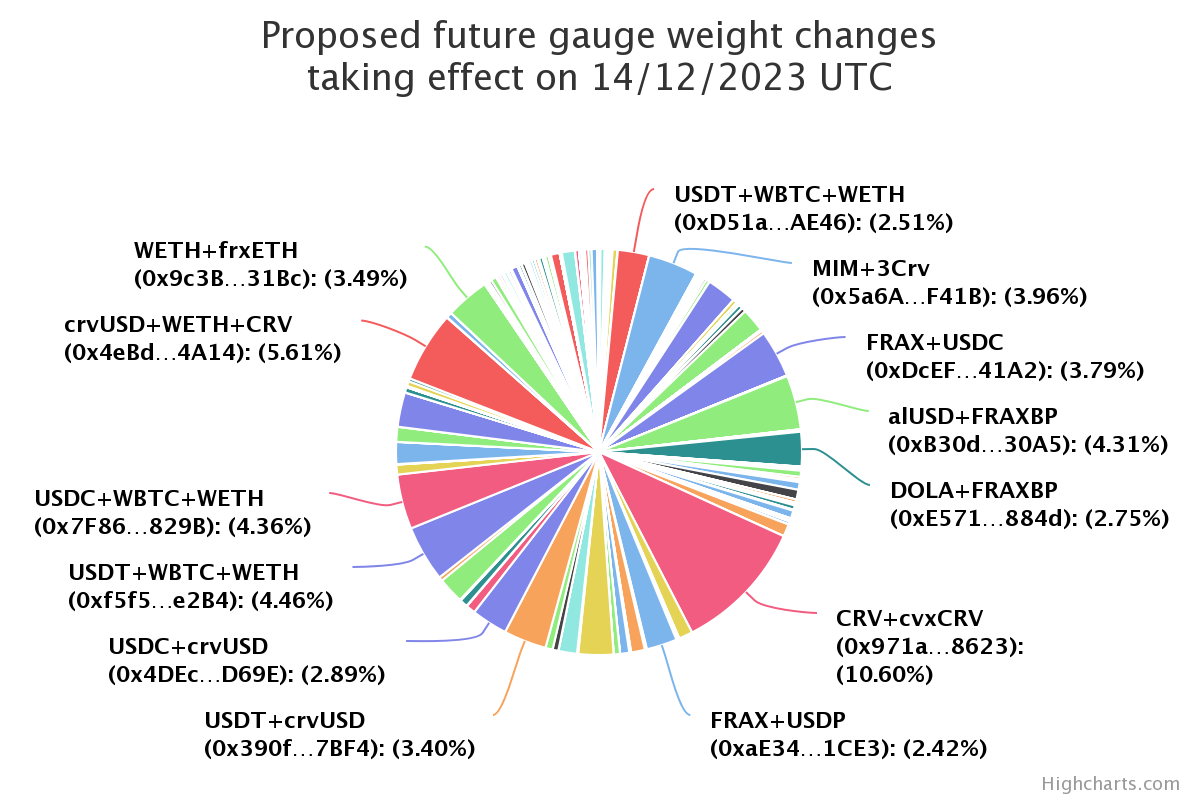

Here is a diagram showing the Gauges repartition for CRV distribution on Curve finance (opens in a new tab); as on 14/12/2023 :

With that concept, it becomes apparent that gauges are not just tools, but voting battlegrounds. The quest for higher rewards turns into a war, as more rewards attract more liquidity providers. The stakes are high, and the rewards are enticing. The addition of vote incentives further fuels this competition, giving users even more reasons to participate in the protocol's governance and fight for their share of the rewards.