🚀 SDT Token

The heart of Stake DAO

For detailed analytics on Stake DAO tokenomics, please visit this Dune dashboard (opens in a new tab).

🤔 What is SDT ?

SDT (Stake DAO Token) is Stake DAO's governance token. It was introduced alongside the launch of the protocol in 2021.

SDT emisions are controlled by the DAO and reward users of the different Stake DAO products.

In early 2022, SDT adopted the veTokenomic model introduced by Curve Finance with its veCRV link to the announcement. (opens in a new tab) With this model, SDT has no intriseque value unless it is locked for a certain amount of time in exchange for veSDT tokens (vote-escrowed SDT).

The DAO is governed by veSDT holders. veSDT holders also benefit from various utilities which are explained in detail in the veSDT page. (opens in a new tab)

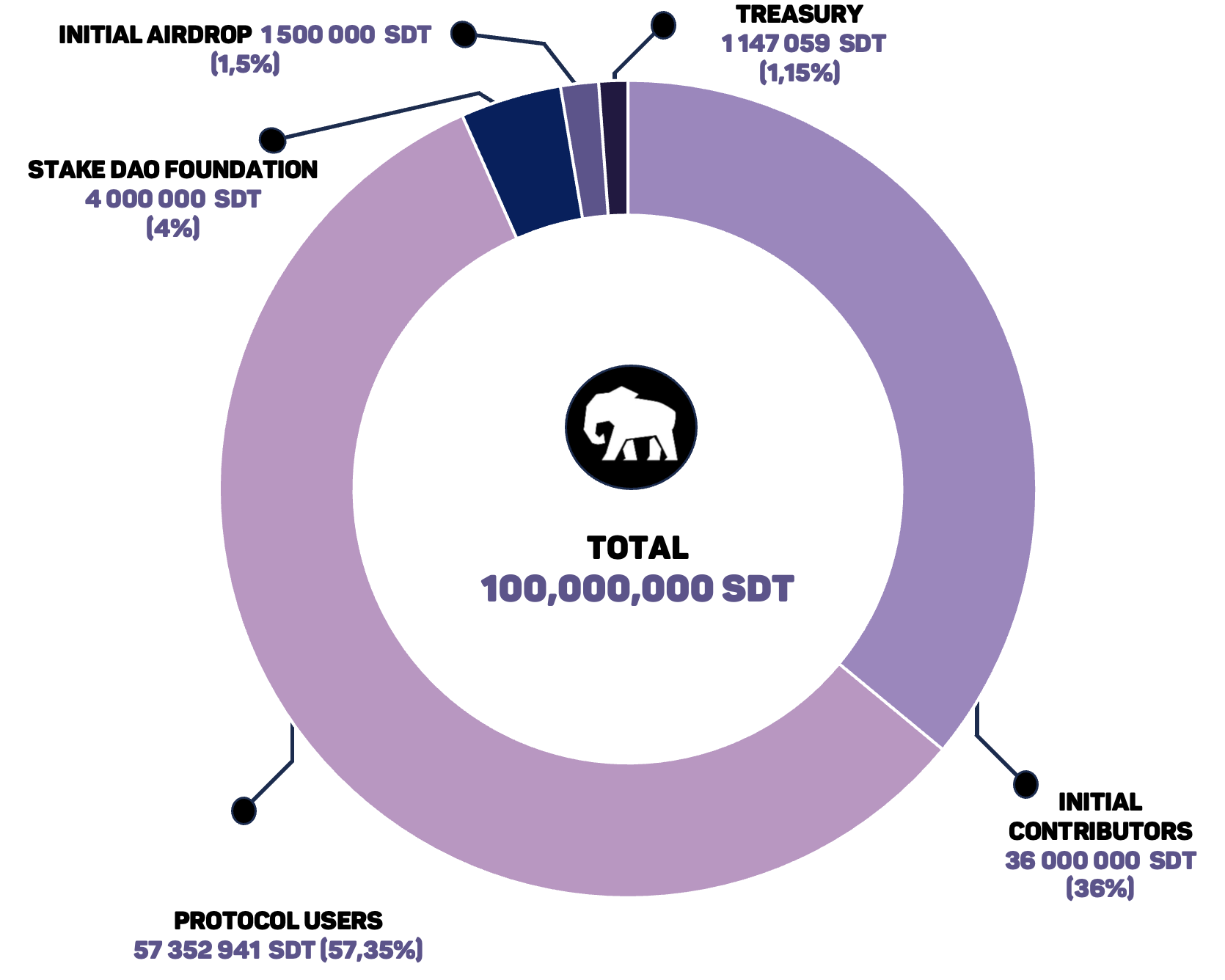

📊 Tokenomics & Distribution

There SDT has a total fully diluted supply of 100,000,000 SDT. It's was distributed as follows:

- Initial airdrop: 1.5% (1,500,000 SDT), distributed on January 20, 2021

- Initial contributors, angel investors, and Foundation: 36% (36,000,000 SDT), linearly vested over 2 years from January 2021

- Stake DAO Foundation (pocket of token kept for future use): 4% (4,000,000 SDT)

- Protocol users: 57.35% (57,352,941 SDT) distributed at a rate set by governance

- Treasury: 1.15% (1,147,059 SDT) distributed at the same rate than for protocol users (every time an SDT is minted from the MasterChef contract, 0.02 SDT are minted and sent to the treasury)

More information on SDT launch and airdrop can be found in this medium post. (opens in a new tab)

More information on the foundation can be found here (opens in a new tab)

The list of addresses eligible to the airdrop can be found here. (opens in a new tab)

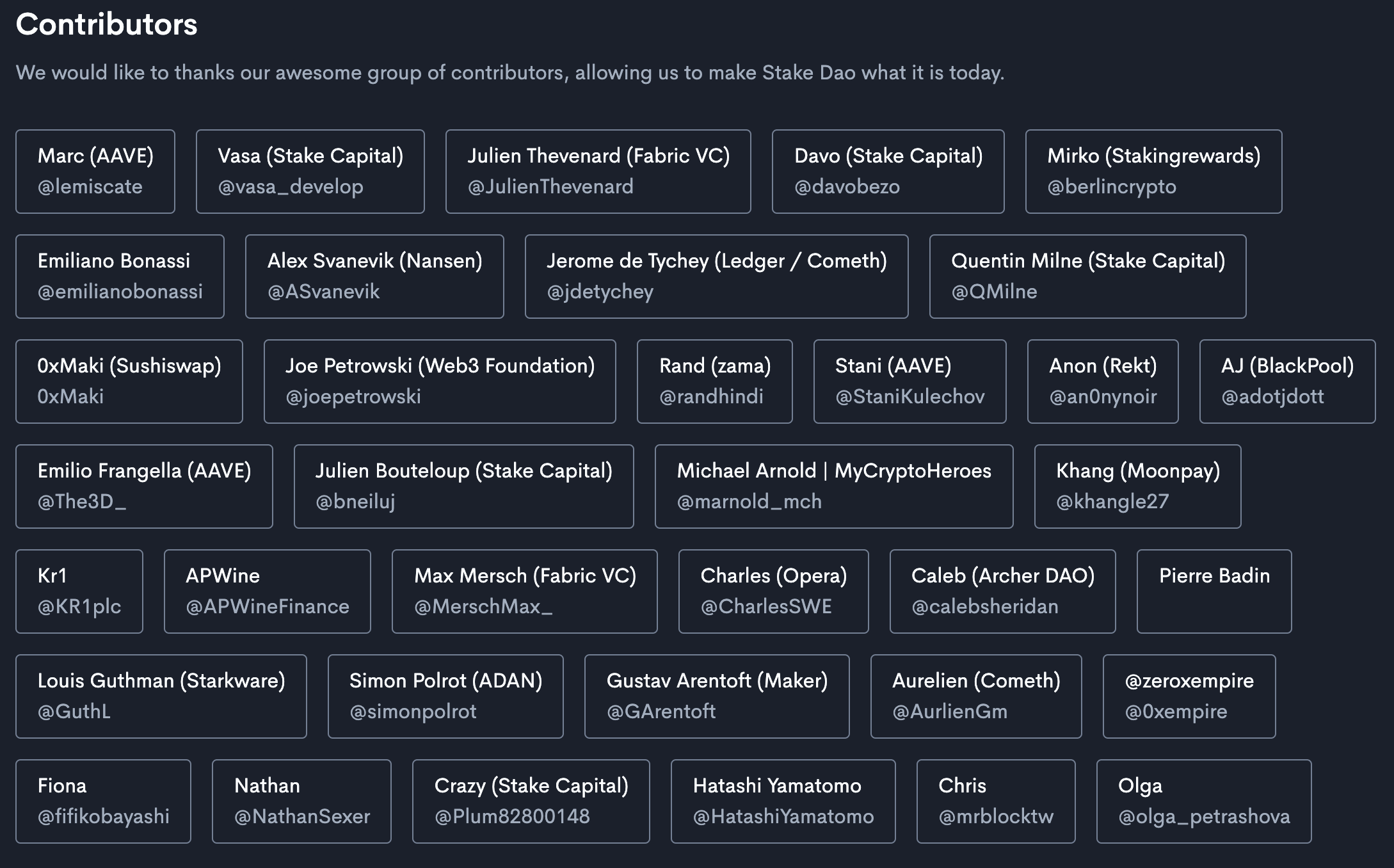

The list of initial investors and contributors can be found here. (opens in a new tab)

Vesting contract: 0xc78fa2af0ca7990bb5ff32c9a728125be58cf247 (opens in a new tab)

📈 SDT inflation

As of January 2023, the initial contributor vests have ended. The only emissions currently are those voted on by governance.

SDT are minted from a Masterchef contract (opens in a new tab) at a fixed rate per Ethereum block, determined by governance.

This rate can be read here under sdtPerBlock.

- You can also check the inflation recipient addresses here under

poolInfo. (the number of pools is checkable viapoolLength). Some pools are not active (i.e. not receiving inflation) - Pool numbers 16 and 17 respectively represent the allocation of SDT for the Strategies and Liquid Lockers Gauge Controllers. These are the contracts responsible for allocating SDT to strategies and lockers based on veSDT gauge votes.

🕰️ Legacy inflation

- Pool number 8 represents the allocation of SDT for a legacy contract called the Dummy Master Token contract, which was used for flexible weekly adjustment of the inflation towards several avenues, including notably NFT staking, Frax gauges, Partnerships, etc.

This adjustment were disclosed in weekly forum posts such as this one (opens in a new tab), until veSDT was launched and SDT inflation allocation became fully governed by veSDT on-chain voting.

Legacy inflation was halted as per the decision in SDGP-31. For more details, see the proposal here (opens in a new tab).

🔍 How to Acquire SDT?

SDT can be received as reward for using Stake DAO products, or it can be acquired via liquidity pools on various decentralised exchanges including Curve Finance, Uniswap, PancakeSwap, ComethSwap, etc.

They can also be acquired through DEX aggregators such as CowSwap, Paraswap, 1inch, Kyber Network. On most DEXs, anyone can deploy a liquidity pool for SDT, so to make sure you are acquiring the correct token, always check that the address of the token is correct.

SDT contract addresses: