OnlyBoost Strategies

The Best Boost You'll Ever Get

OnlyBoost Strategies are currently exclusively available for Curve.

🤔 Why OnlyBoost?

In the early days of Curve, users had limited options to boost their liquidity:

- They could use Curve directly, boosting with their own veCRV balance.

- Or they could use Convex (minus a fee), built on top of Curve, to profit from Convex's veCRV balance.

As multiple protocols like Stake DAO, Yearn, etc., emerged, it became a challenge for users to choose the best option to boost their LPs' yield.

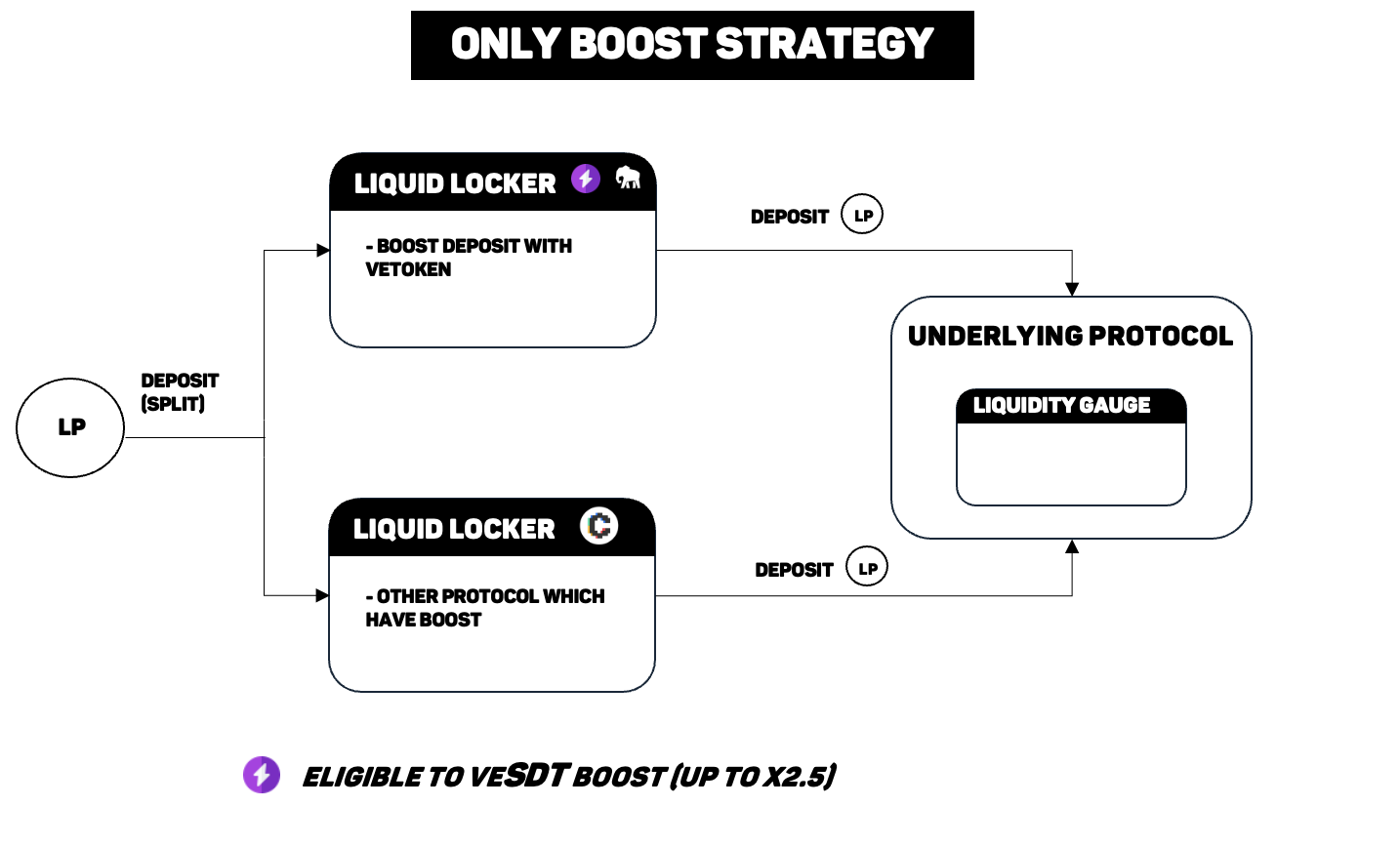

This is where OnlyBoost strategies come into play: They optimize boost by distributing LPs across different platforms.

Here is a diagram to summarize how OnlyBoost strategies works

💸 Performance fees

The performance fees are the same as on regular Curve strategies.

🎛️ How Does It Work?

Stake DAO doesn't simply fill up their own locker first and then deposit the remaining into other protocols. Although this method could work, it's not efficient enough to cover the fees associated with Convex. Instead, Stake DAO employs a calculated approach, using a specific formula to determine the optimal amount to deposit in its own locker first.

The OnlyBoost formula was recently simplified through SDGP-46 (opens in a new tab) to improve gas efficiency while maintaining optimal yields.

Here is the current formula:

Where:

- balance_Convex: Amount of LP token (deposited) held by Convex

- veCRV_StakeDAO: The veCRV balance of Stake DAO (including delegated veCRV)

- veCRV_Convex: The veCRV balance of Convex (including delegated veCRV)

This formula calculates the optimal amount to deposit in Stake DAO Liquid Lockers, from the total value to be deposited, before allocating the remaining to Convex.