Stake on Strategies

You have just read the Voting Escrow Guide and you are willing to get incentivized for providing liquidity. Unfortunately, you don't have any or to few governance tokens locked to boost your rewards.

Here's the solution : Stake DAO Strategies.

How ?

Open the Yield tab (opens in a new tab) on the Stake DAO website and compare opportunities.

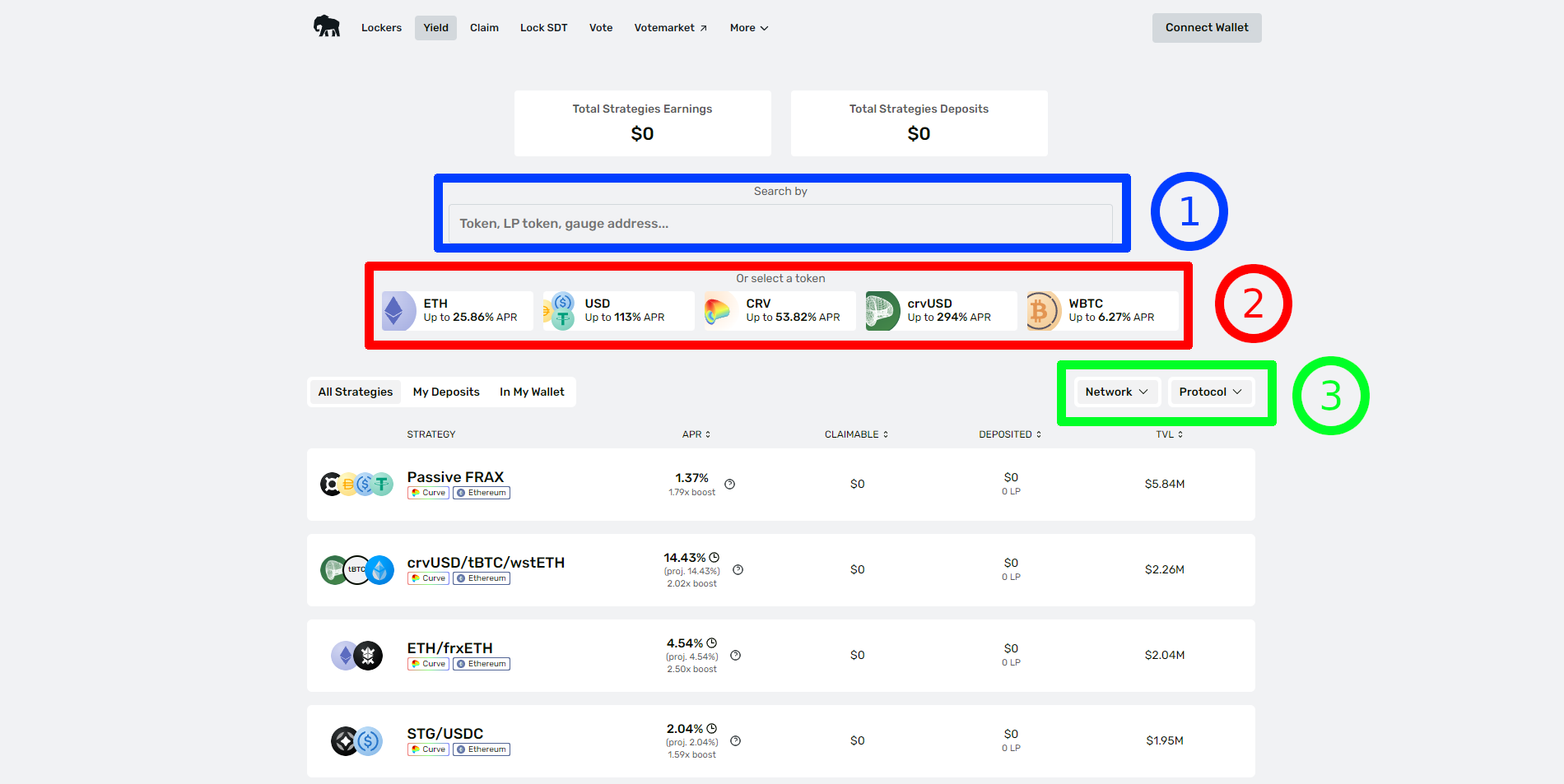

On this page, you have many filters to help you find what you are looking for :

- 1 : a searchbar, in which you can add strategy name, token, or even if you have a specific strategy that you are looking for, you can input the LP token or protocol gauge address.

- 2 : Token filters, these are meant to only display strategies based on ETH, or usd stables, or CRV, and then you can easily compare yields.

- 3 : Network and protocol filters. If you are willing to see only Curve strategies on mainnet for exemple, you can select Ethereum as a network and Curve as a Protocol. You can even select multiple protocols.

How do I chose my strategy ?

Let's take an exemple :

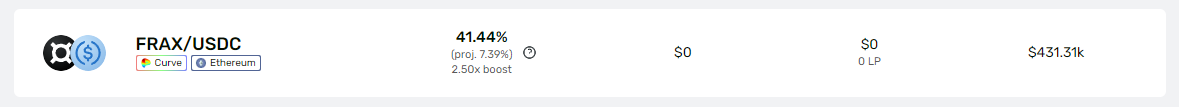

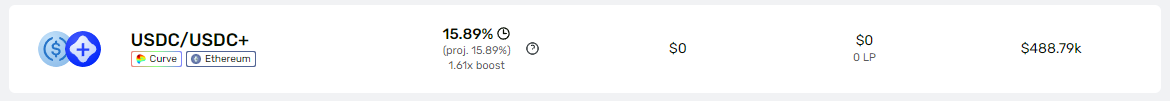

This is the FRAX/USDC strategy (also known as FRAXBP). you have few information on this card that can help you compare to others:

- Below the name, you have the underlying protocol and the chain.

- Second column is the APR (Annual Percentage Rate), with three lines:

- First one is the current APR for the week. Rewards are beeing streamed at a

rateby our gauge, and based on the TVL we compute this APR. More details on Strategies APR Calculation. - Second one is the projected APR, it is an estimation of the APR for the following week.

- Third one is the boost provided by the Liquid Locker. You can enjoy 2.50x rewards without locking any CRV !

- First one is the current APR for the week. Rewards are beeing streamed at a

- The two following columns are your claimable rewards, then your staked LP amount.

- Last one is the TVL (Total Value Locked)

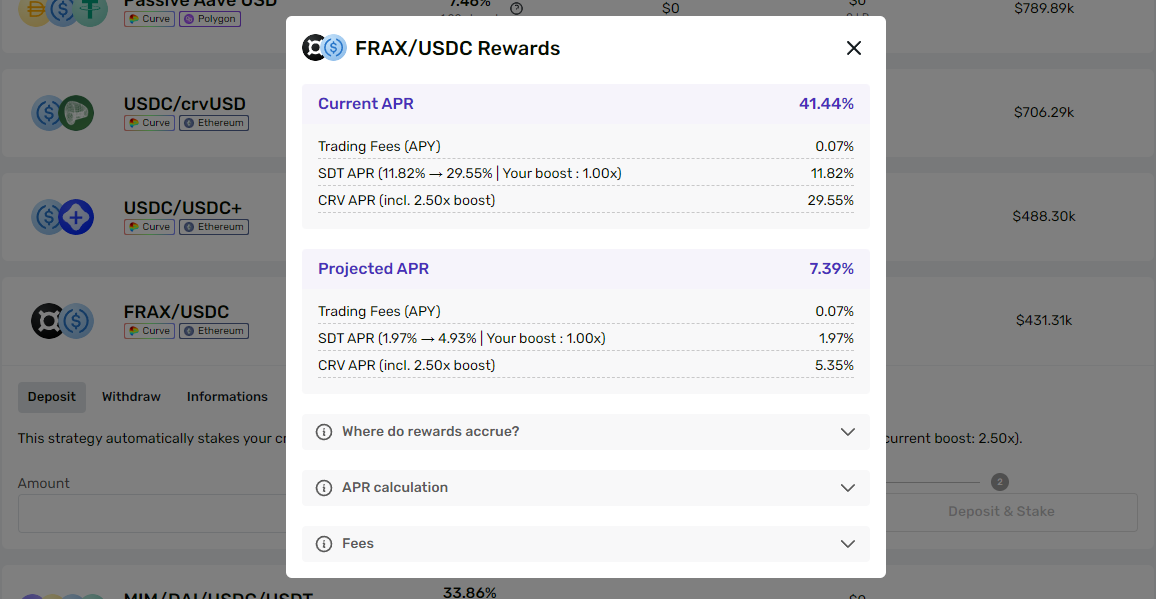

Also when you click on the little ? next to the APR, you get more details on the rewards.

You can see the details of what are the rewards from staking LP tokens, and what are the expected changes for following week.

How do I get in ?

First, you need to provide the liquidity on the pool corresponding to the strategy on the underlying protocol and get the LP token. Once done, you can just click on the strategy and deposit.

I have deposited, but my claimable rewards doesn't seem to grow.

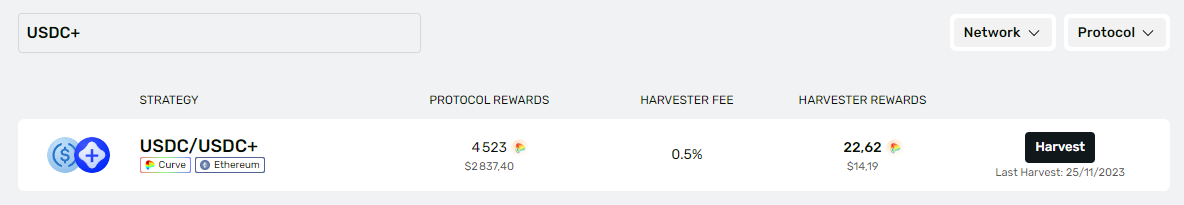

This probably means that the strategy has not been harvested for 7 days.

Next to the APR, you can see a little clock icon. This clock means that the strategy does not currently stream rewards, but don't worry rewards are still accumulating ! The accumulated rewards will be distributed during the 7 coming days once the harvest is triggered. Anyone can harvest a strategy on the DAO management page (opens in a new tab), and start streaming rewards again. A little harvester fee is sent to the harvester to compensate gas cost.

I have found a new pool on the protocol, but I can't find it on the list.

The strategy is probably not deployed, but anyone can deploy it. To deploy it you need to put the LP address or the gauge address into the search bar. To be deployed, the pool must have a gauge and a weight on the protocols' rewards votes.